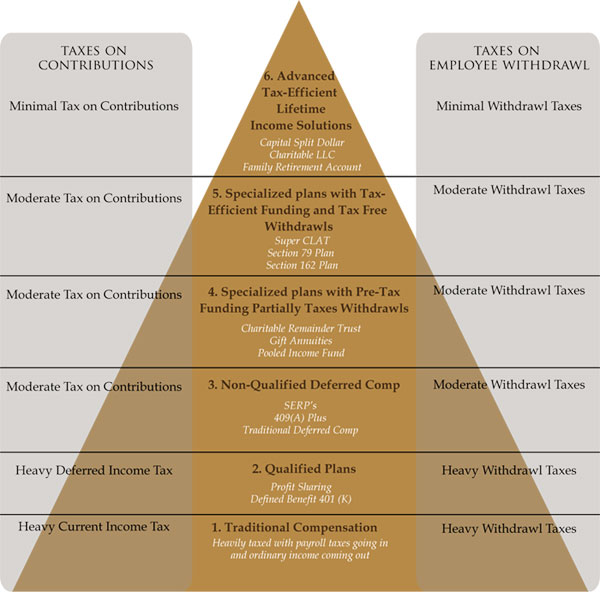

Most business owners are still at level one of the 6-level pyramid shown below. They pay taxes on income when it is earned, invest the money in taxable investments, and pay taxes when dividends and gains are distributed. Even if advancing to level 2, there are still substantial self-employment taxes that reduce the benefits of qualified plan deductions, and there are ordinary income taxes when money is distributed from qualified plans. Therefore, astute clients and advisers advance to level 6. This brochure explains Level 6 strategies.

Businesses can generate tax deductions from Level 6 planning instruments such as Capital Split Dollar and Captive Insurance Companies. These techniques are explained on this page and the following pages.

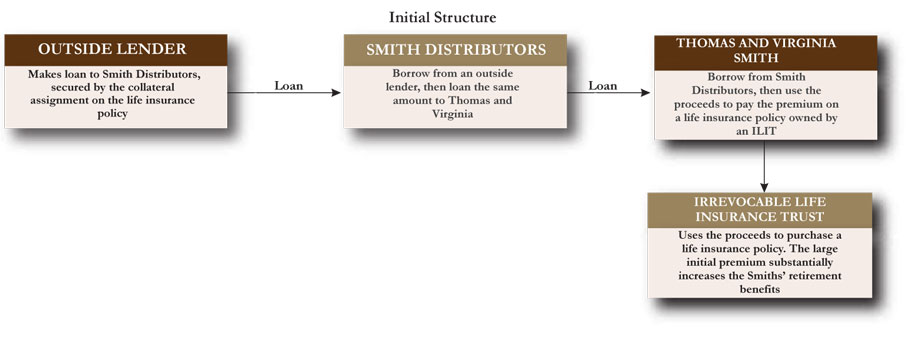

Capital Split Dollar

COMPARISON OF BENEFITS

Capital Split Dollar is an executive compensation program that generates current income tax deductions while funding a trust that can produce tax-free retirement income and/or transfers to family members. The insurance in the trust can also fund a buy-sell program to help junior executives easily acquire equity in the business when the senior owners retire or die.

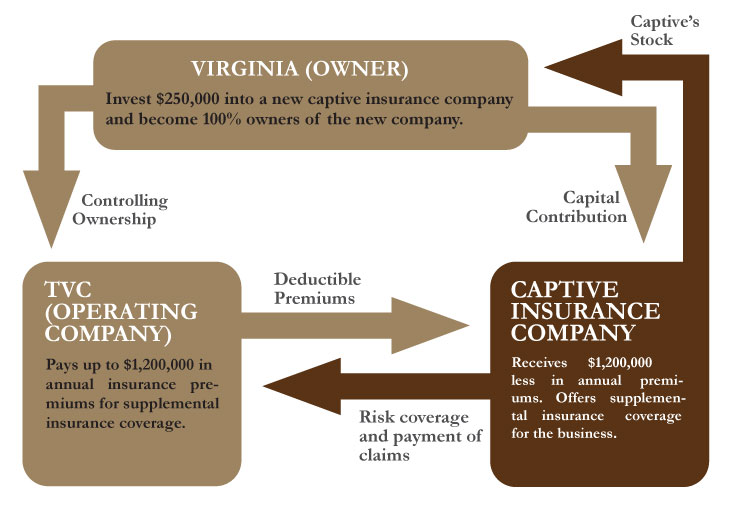

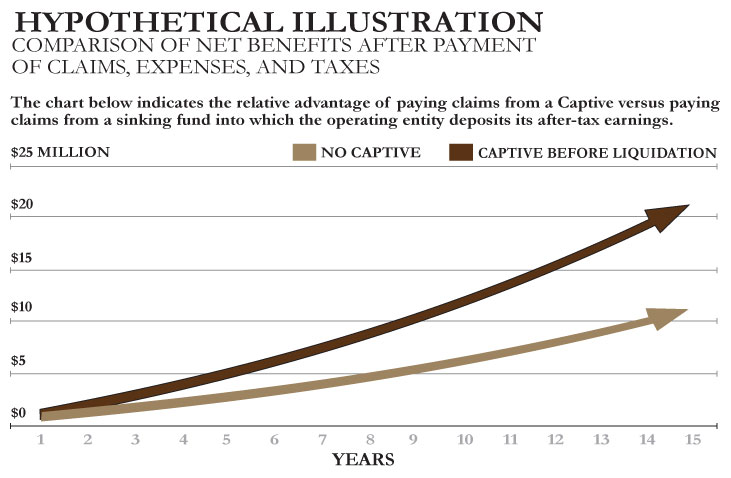

A business can take current income tax deductions when funding excess income into a Captive Insurance Company. The Captive can insure risks that are not easily insured by third party commercial insurance companies. If claims are paid by the company, the funds in the captive can grow tax-efficiently. By combining the captive with a preferred LLC, it is possible to transfer capital from the captive tax-efficiently.

A business can take current income tax deductions when funding excess income into a Captive Insurance Company. The Captive can insure risks that are not easily insured by third party commercial insurance companies. If claims are paid by the company, the funds in the captive can grow tax-efficiently. By combining the captive with a preferred LLC, it is possible to transfer capital from the captive tax-efficiently.

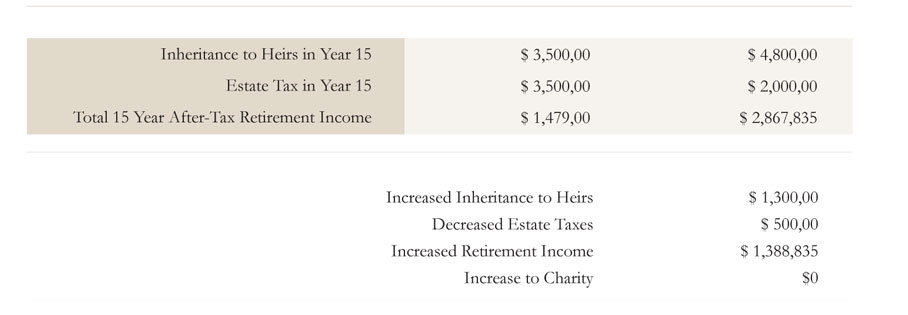

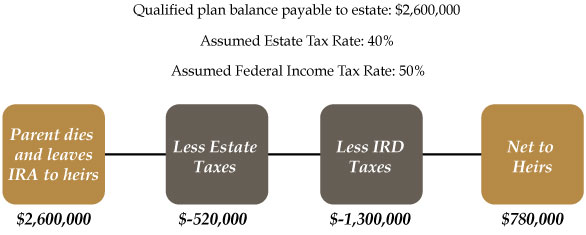

Americans have more than $22 Trillion in retirement assets. An estimated two-thirds of this may be subject to estate taxes at 40%. Moreover, much of the income will come out at top marginal rates over 50%. It is not uncommon to see 70% of the retirement assets lost to taxes as shown here.

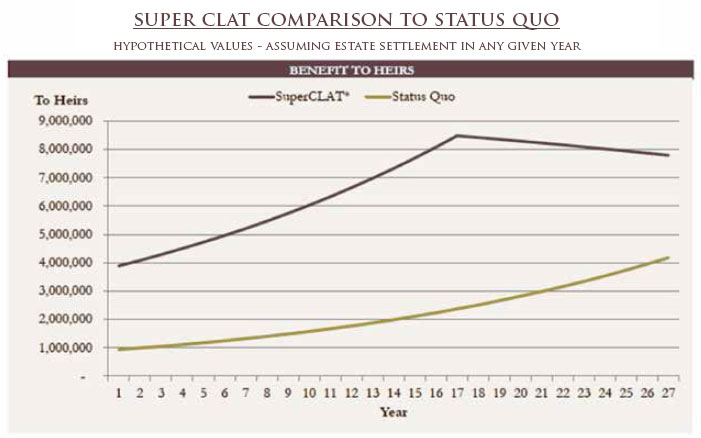

IRA funds or other retirement assets are rolled into a profit sharing plan. The profit sharing plan funds a policy that is distributed in year 4 to a super CLAT. The CLAT uses life insurance to fund charity and distribute assets to a trust for family.